US derivatives watchdog wants to ban betting on election results Forecast markets are an important source of data, economists say.

A version of this story appeared in Us The Guidance Newsletter on 19th August. Sign up Here.

Written by Ben Weiss News Economists are rushing to the defense of prediction markets like Polymarket.

That is after the Commodity Futures Trading Commission Proposed A ban in May on certain “events contracts” — derivatives that allow an investor to bet on events such as elections, sports games or awards shows.

US derivatives watchdog argument? Unregulated speculative markets put democracy and national security at risk.

The CFTC is concerned that these markets could create financial incentives for individuals to assassinate the president or commit an act of terrorism to win a bet.

It also warned that these markets are open to manipulation.

Insiders involved in an event can bet using an unfair information advantage – think a sports coach betting on the outcome of his team's game.

Or voters can choose candidates based on betting odds on whether they are the right person to hold the high office.

Join the community to get our latest articles and updates

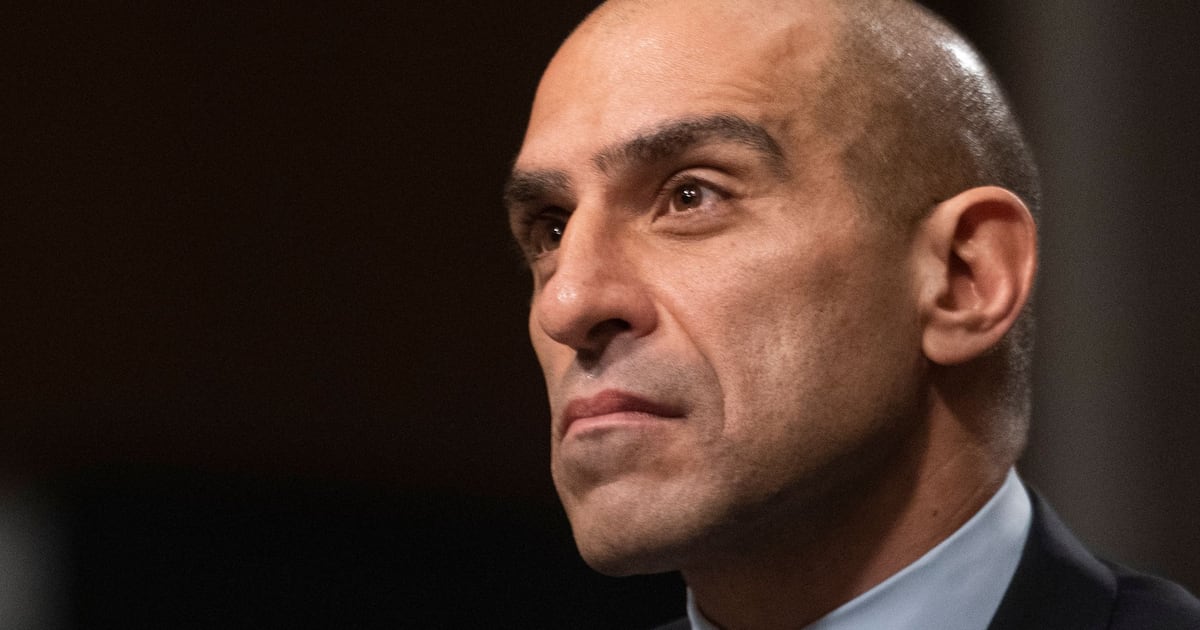

“More events contracts will be listed for trading in 2021 than have been listed in the previous 15 years,” CFTC Chair Rostin Behnam said.

In response, the commission proposed to effectively strengthen the regulator's ban on contracts for events that promote “gaming” or gambling.

Polymarket does not officially allow US residents to use its platform Settled In 2022 the CFTC was sued and fined $1.4 million.

However, there are plenty of guides online to circumvent the ban, and the market's most prolific is in Las Vegas.

Supercharged

The US presidential election has supercharged Polymarket.

Its most liquid bet is the $640 million market on whether Republican Donald Trump or Democrat Kamala Harris will win.

Polymarket's monthly trading volume quadrupled to $387 million in July. Dune Analytics.

So any reduction in election-related betting is bad news for the platform.

Still, prediction markets have powerful defenders in the crypto industry.

Heavy weight exchanges like Coinbase, GeminiAnd Crypto.com wrote to the Commission.

Their letter states that prediction markets provide more accurate and cheaper predictive data than other forms of forecasting.

Ben interviews economists who agree that forecast markets are surprisingly accurate and factor in market manipulation.

One of Ben's sources, however, echoes the CFTC's fear that these markets need regulation because they provide an incentive to throw elections.

Regulatory proposals are often watered down or rewritten as they churn through the rulemaking mill, so the CFTC's proposal is not necessarily indicative of what the law will look like in the future.

But since Polymarket is so big, regulators don't ignore it.

Reach me at [email protected].

Related TopicsPOLYMARKETCFTC