Cardano’s Chang Hark fork has just gone live. It brings onchain, decentralized governance to blockchain. The transition will be complete with a second upgrade later this year.

The Cardano blockchain has completed the first phase of its Chang hard fork, setting the stage for more decentralized governance.

At 10.44am London time on Sunday, Cardano officially began the process of transferring control of the $13 billion blockchain to its native ADA token holders.

According to Frederic Gregard, CEO of the Cardano Foundation, many in the Cardano community were drawn to the network because of the promise of a decentralized governance model.

“Every ADA holder can contribute to the evolution of the ecosystem,” Gregard said News. “A community cooperates, innovates and governs by mutual agreement.”

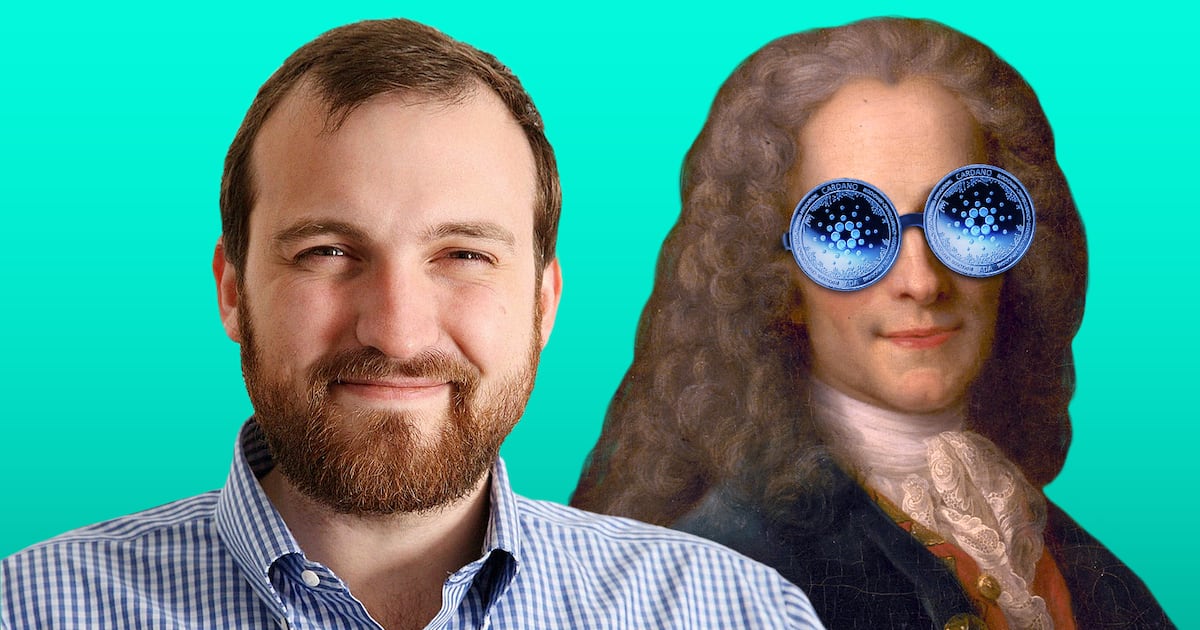

Cardano was the first major blockchain to implement a token-based governance system. It was named the Age of Change VoltaireAfter the French author and free speech advocate.

Blockchain development was previously managed by the Cardano Foundation and EMURGO, Cardano’s official commercial arm, as well as founder Charles Hoskinson’s blockchain engineering firm, Input Output Global.

While many Cardano fans are celebrating the move, decentralization is a double-edged sword.

The governance system, known as decentralized autonomous organizations – or DAOs – has received criticism.

Join the community to get our latest articles and updates

Detractors say most DAOs have exorbitant budgets, suffer from inadequate checks and balances, and are controlled by a few powerful stakeholders.

Cardano’s new regime is the latest example of a crypto project’s adherence to the ideal of decentralization.

Why decentralization?

“Without a central authority controlling the network, it is very difficult for governments or corporations to censor information or transactions,” said Florian Volleri, co-founder of Liquid Labs, the company behind Cardano’s lending protocol Liquid. News.

This makes Cardano even more attractive to organizations looking to dip their toes into decentralized finance or DeFi, Voleri said.

But there is stiff competition. Ethereum, which hosts the largest DeFi ecosystem, has attracted $9 trillion asset manager BlackRock, among others.

Pablo Bejarano, CEO of Cardano-based asset manager PBG, said Cardano’s move toward decentralized governance highlights the lack of such a system in other blockchains.

On competitive blockchains, “decision-making is often centralized among a few players,” he said. News.

However, decentralized governance is not the only consideration.

Cardano achieves only smart contract functionality that can create DeFi protocols on the blockchain in 2021.

It also struggled with a Unspent transaction output — or UTXO — problem. Simply put, only one user can interact with certain DeFi protocols at any time, such as decentralized exchange liquidity pools.

Other top blockchains like Ethereum and Solana do not have this problem.

The UTXO problem can cause transactions to fail, for example, when multiple users try to exchange the same tokens on a decentralized exchange at the same time – a big problem for any blockchain intended to scale to millions of users.

Crypto value is deposited to Cardano DeFi protocols.

Avoiding DAO Distress

Although Cardano’s governance is more decentralized, the network does not want to be associated with the original DAOs and the problems they faced.

“In a DAO, governance token holders who vote on proposals typically make decisions, often with only a few checks or balances,” Gregard said.

Cardano’s new system, called DReps, will represent community representatives, token holders, who participate in voting on governance measures.

The DReps join all three co-operative legislative bodies – in a tripartite model – to make decisions.

Gregard said all important stakeholders have a voice and checks and balances are ensured.

However, actualizing such a system is easier said than done.

Having thousands of ADA token holders, many of whom do not fully understand the new governance system, may invite frustration that they do not have the same control over the project and its finances that DAO members do.

Although the Chang hard fork has started, Cardano’s transition to decentralized governance is not yet complete.

The second upgrade will be Unlock The final features of the regime later this year.

There is Tim Craig News’ Edinburgh-based DeFi correspondent. Reach out with tips at [email protected].

Related Topics Cardano